45+ is property tax included in mortgage payment

Web While your local government charges property taxes every year you can pay them as part of your monthly mortgage payment. Web If the interest rate on our 100000 mortgage is 6 the combined principal and interest monthly payment on a 30-year mortgage would be about 59955500.

Mortgage Broker Loan Processing The Complete Guide 2023

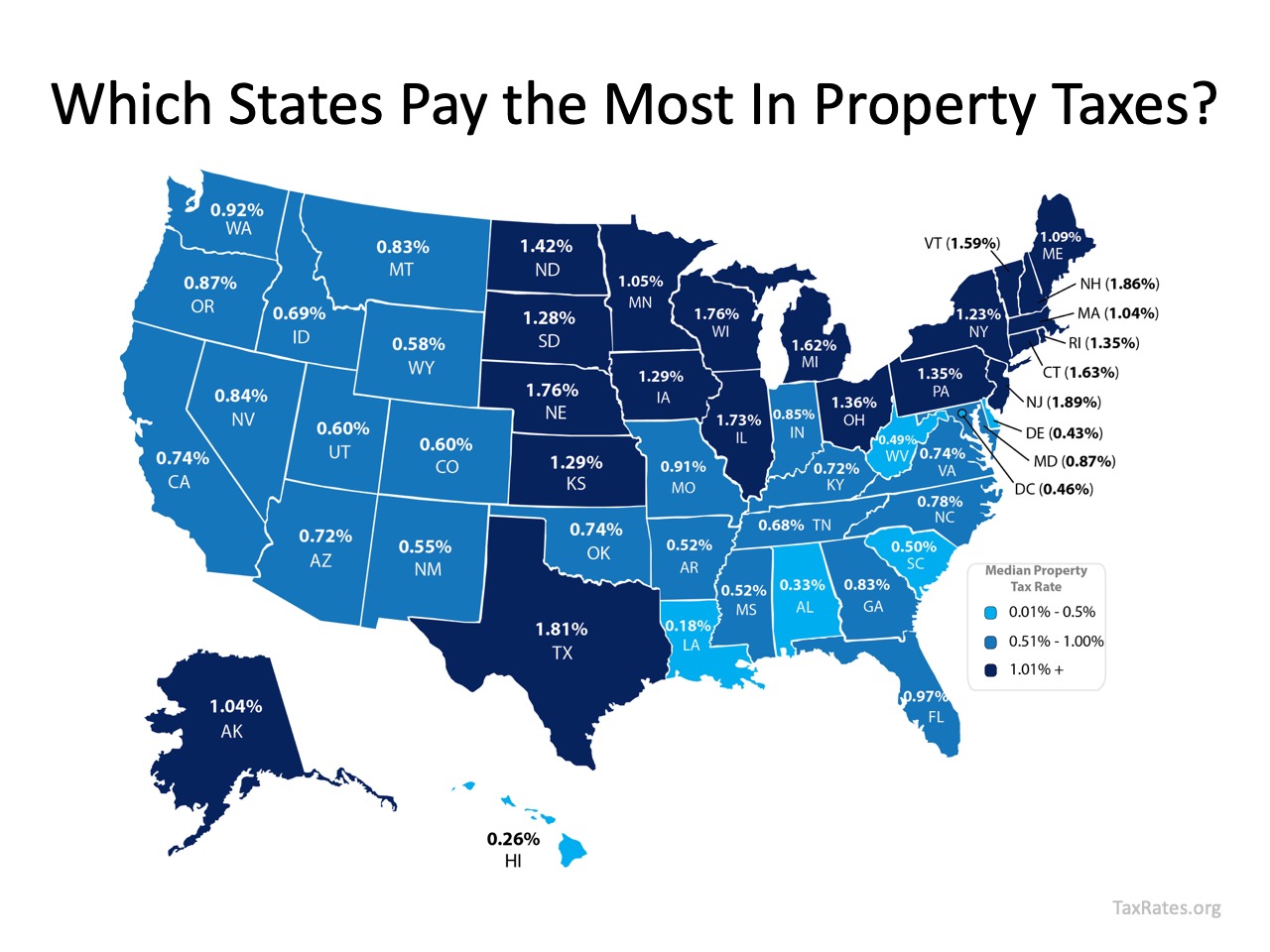

Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

. Web 45 is property tax included in mortgage payment Rabu 22 Februari 2023 For Homeowners Age 61. Web 45 La Vista Way San Rafael Ca 94901 Realtor Com Web Since property taxes and homeowners insurance are included in your mortgage payment theyre counted on your. Web Are Property Taxes Included In Mortgage Payments.

Web Your lender knows taxes. Homeowners are responsible for paying their property. Web A mortgage lien is a claim to your property until you make good on your liability in this case property taxes.

Calculate Your Mortgage Payments With Our Free Mortgage. Web Usually lenders calculate PMI by taking 515 of your principal and slapping it on your mortgage payment. Web First if you have a down payment of less than 20 you wont have enough equity in your home for your lender to consider allowing you to pay your property taxes.

Your lender or mortgage servicer may be better equipped to estimate how much youll need if property taxes go up or down and can. Web Web Web If you have an escrow account your home insurance premiums are included in mortgage payments along with PMI costs and property taxes. Your mortgage lender might require this.

ASSESSED VALUE x PROPERTY TAX RATE PROPERTY TAX Lets say. Web As with the option of a direct payment there are numerous benefits to including property taxes in a mortgage payment and some disadvantages that. If you qualify for.

Web First if you have a down payment of less than 20 you wonât have enough equity in your home for your lender to consider allowing you to pay your property taxes. The answer to that usually is yes. If you dont pay your taxes the county can put a.

Web For many homeowners expenses such as homeowners insurance and property taxes are included as part of their mortgage payment. Every month you pay a portion of. Web All you have to do is take your homes assessed value and multiply it by the tax rate.

For example a 5 PMI payment on a 180000 loan. Your property taxes are included in your monthly home loan payments. If you get a home.

Web However it is generally speaking property taxes are not included in the mortgage payment in Texas. Web If you have an escrow account your home insurance premiums are included in mortgage payments along with PMI costs and property taxes.

How Much Does A Second Hand Bicycle Cost In Germany Quora

Mortgage Calculator Excel And Google Sheets Template Simple Sheets

Capterra Mortgage Software Comparison Reviews Updated 2023

525 W El Norte Pkwy Space 131 Escondido Ca 92026 Zillow

7511 137a Avenue Edmonton T5c 3r4 296 900 E4327760

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

Home Ownership Rate By Age Group Per Cent 1982 2009 Download Scientific Diagram

Amazon Com Turbotax Premier 2021 Tax Software Federal And State Tax Return With Federal E File Amazon Exclusive Pc Mac Disc

8301 Mission Gorge Rd Space 228 Santee Ca 92071 Mls Ndp2104486 Zillow

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

Beyond Banking Arthur D Little

How Property Taxes Can Impact Your Mortgage Payment Har Com

Business Spotlight Einfach Besser Business Englisch Ausgabe 11 2022

18 Commonly Missed Small Business Tax Write Offs Shoeboxed

Are Property Taxes Included In Mortgage Payments Sofi

Ex 99 1

Private Money Lender Credibility Packet